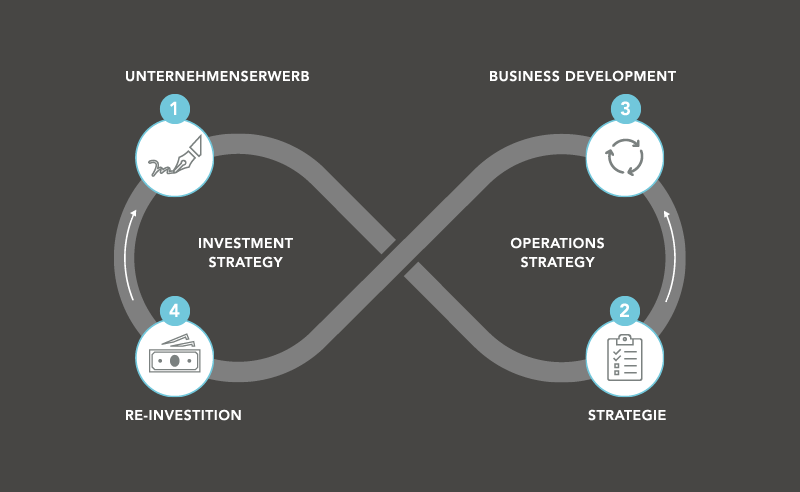

Anwert Technologies is an emerging technology holding company with locations in Europe and the USA. Our focus is on acquiring high-growth technology companies and investing in high/deep-tech scale-ups.

Active business development includes operational support and strategic buy-and-build activities with add-on acquisitions and targeted new formations.

The underlying vision is to build a long-term and strategically oriented technology group.

Our Focus

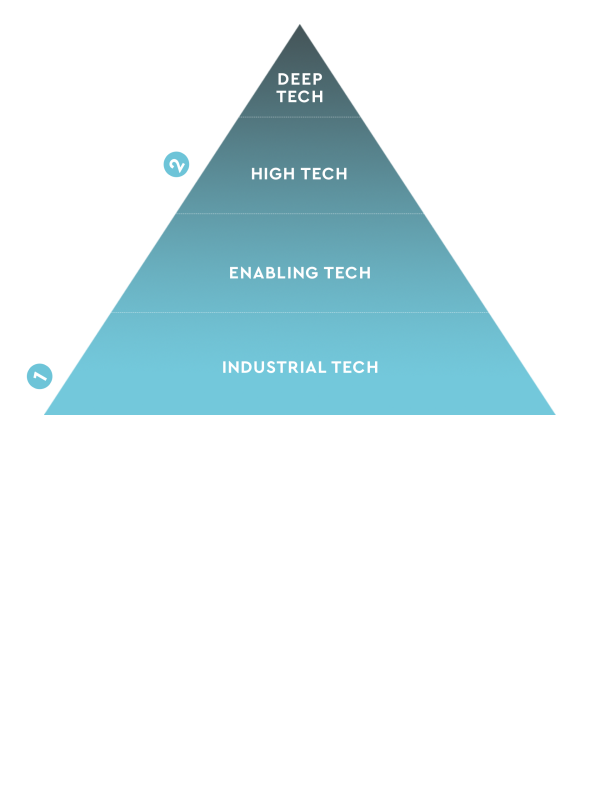

The goal of Anwert Technologies is to acquire a profitable and scalable company from the industrial or enabling tech sector with annual revenues starting at approx..10 million euros, which meets the following investment criteria:

The focus is on industrial technology fields (Industrial Tech) and/or established application technologies (Enabling Tech).

The integration of high and deep-tech applications through internal development activities and complementary M&A activities aims to strengthen the technological position.

Cooperation with selected scale-up investments of Anwert Technologies should utilize technological synergies and enable technology transfer without requiring corporate interlocking or cross-participation.

Anwert Technologies pursues a strategic platform approach, where there is a clear focus on the acquired company . Anwert Technologies actively supports business development and the implementation of an acquisition strategy.

Value and Growth-Oriented Corporate Development

The company should be held long-term by Anwert Technologies and further developed into a leading and powerful “Hidden Champion.”

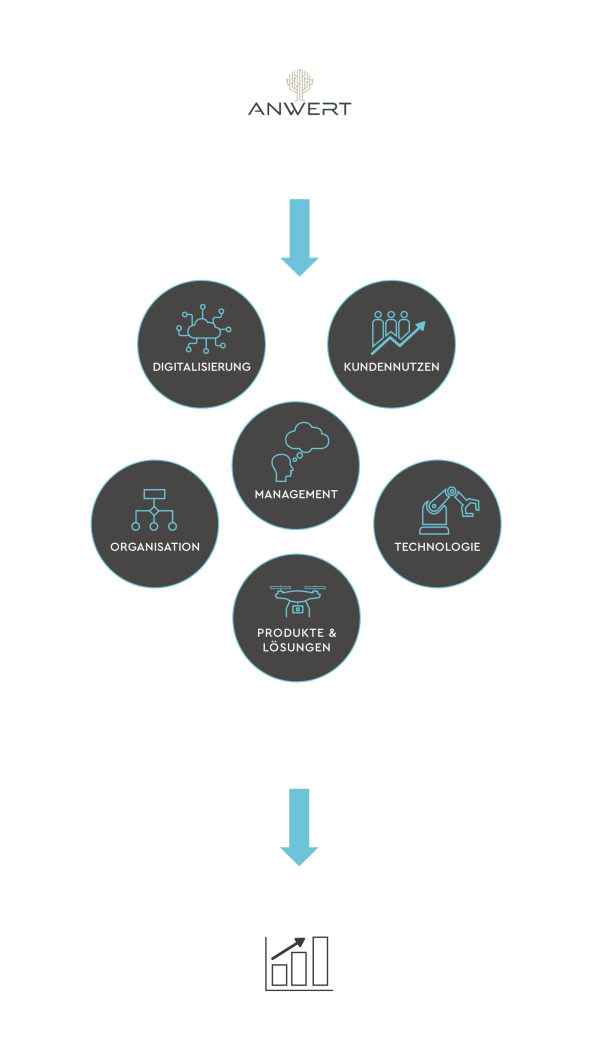

ADDED VALUE through Focus

The platform approach aims to give the investment company the necessary attention and ensure the resources for a smooth development. This creates the basis for a strong USP and value-oriented growth.

Our Competencies

The team at Anwert Technologies consists of successful entrepreneurs and management personalities from high-growth technology companies as well as the investment, financing, and investment sectors.

Leo Strohmayr

Managing Partner

As the initiator of Anwert Technologies, he has over 20 years of experience in the medium-sized and technology-oriented investment business. Most recently, he was a very successful board member of INVEST AG – Austria’s leading investment company – for 13 years, gaining extensive experience in a large number of transactions, closely supporting portfolio companies and building up an excellent track record.

Prior to this, he was involved in the successful establishment of a VC company and held various positions in the SME sector. Leo Strohmayr has been active as an entrepreneur for several years now and is involved in several companies as a co-investor. In addition, he supports selected companies as a supervisory board member, advisory board member and sparring partner in various situations.

Martina Scheibelauer

Supervisory Board Member

She has over 20 years of professional experience in corporate & investment banking at JPMorgan Chase & Société Générale in London, the UniCredit Group, and Raiffeisen in various leadership positions, as well as several years of experience as a senior manager with country responsibility for a Swiss asset manager focused on sustainability.

As an independent entrepreneur, Martina Scheibelauer accompanies private and public companies as a supervisory board member, advisory board member, and partner in complex financing and investment issues, focusing on projects and companies.

Herbert Stöger

Chairman of the Supervisory Board

He is the founder and main shareholder of the x-tention group, which under his leadership has been expanded into a Hidden Champion with locations in Austria, Germany, Switzerland, Great Britain, and the USA. Today, over 800 qualified employees worldwide serve more than 1,000 satisfied customers mainly in the healthcare industry with their own IT solutions for digital data exchange. This results in 100 million euros in revenue.

The strategically oriented entrepreneur Herbert Stöger supports Anwert Technologies as a supervisory board member with his extensive experience in growth, both organically and through M&A, joint ventures, and cooperation.

INg. johannes Reichenberger

Supervisory Board Member

He is the main shareholder of mocca-group.ai, which includes the ventopay he founded, as well as the Delegate Group. Mocca-group.ai is an innovation and technology leader along the digital foodservice process chain in contract catering and community catering (company canteens, healthcare facilities, public gastronomy such as in stadiums). At locations throughout the DACH region, but also in Australia and the USA, 150 employees serve very renowned, long-standing customers.

As a very experienced entrepreneur from a young age, Johannes Reichenberger knows the challenges of continuous development work and company building. He combines strategic foresight with a clear customer focus, based on deep technological know-how from IT platform and SW/HW development to AI integration.

The mix of competencies and experience of the team is an excellent foundation for the successful development of Anwert Technologies’ future investment company.

Anwert Technologies enables active entrepreneurs, owner families, private foundations, financial investors, or corporations – as an alternative to private equity and pure strategic corporate investors – a value-oriented sale and ensures the independent further development of the company.

An entrepreneurial participation of the management or a re-participation of the previous shareholders is welcomed – under clearly defined conditions for both sides.

For scale-up companies, we’re an entrepreneurial alternative to VC financing.

Anwert Technologies is convinced that a company can develop optimally if all partners involved in the transaction process work together side-by-side. These are

“ANWERT,” a Bavarian-Austrian term, represents the values of reputation, respect, and appreciation. Guided by this ethos, we are committed to developing our company sustainably, with a long-term and responsible perspective.

We look forward to a conversation

Please send us a short message. We will get back to you.

Contact

Anwert Technologies AG

Wiedner Gürtel 13/Turm 24

The Icon Vienna

1100 Vienna

Links

Follow us